The European packaging industry around (condiment) sauces is in an exciting phase of development. The market shows significant growth opportunities. Drivers are changing consumer habits, new product variations and an increasing demand for practical, sustainable packaging solutions. We provide you with a comprehensive overview of current market developments, the packaging systems in demand and the leading suppliers and brand owners.

Market overview

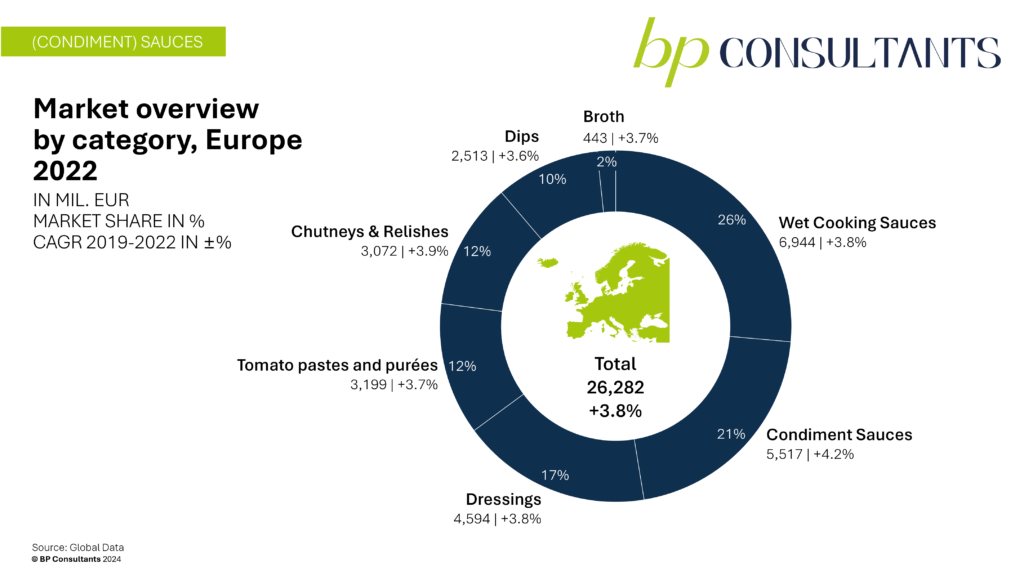

- The European market for (condiment) sauces recorded average annual growth of 3.8 per cent between 2019 and 2022. This increased the market volume to 26.3 billion euros.

- Reasons for growth: The growth reflects the increasing demand for sauces that offer authentic flavour profiles as well as healthy and practical cooking solutions.

- Market demand: Within the market, demand for wet cooking sauces dominates (26 per cent market share), followed by condiment sauces and dressings, which together account for more than half of the market share.

- Market growth: The condiment sauces sub-segment is growing particularly dynamically, followed by chutneys and relishes as well as wet cooking sauces/dressings.

- Market size: In regional terms, Germany is the largest market, followed by the UK and France.

- The strongest growth was recorded in France and Belgium (+6.1 per cent), followed by Sweden and Spain (+4.9 per cent each) along with Germany (+4.7 per cent).

Packaging systems: Demand and growth

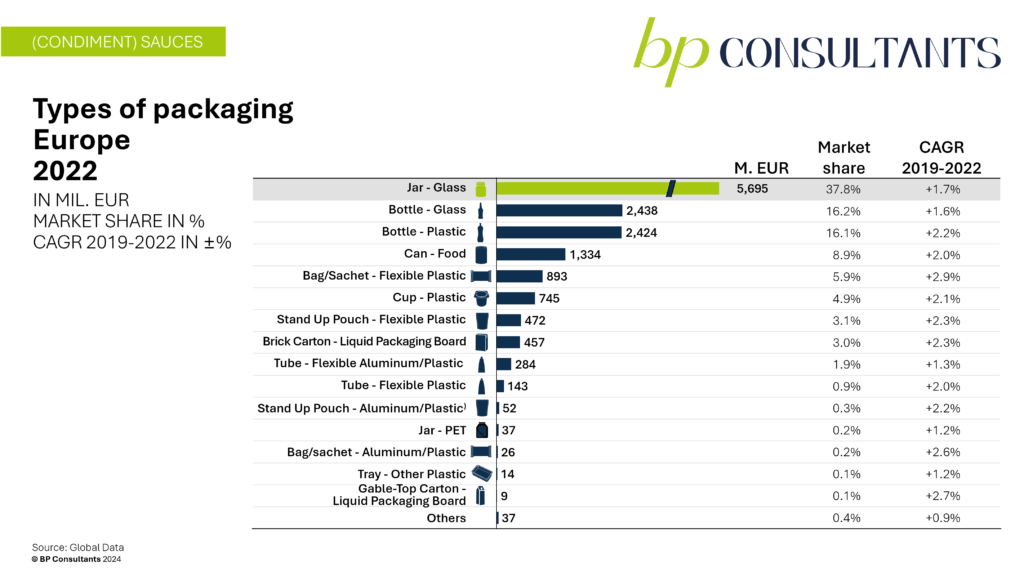

If we analyse demand at the material level, it becomes clear, that:

- The glass jar is the dominant packaging system with a market share of around 38 per cent.

- Glass and plastic bottles follow in almost equal second place with a market share of 16 per cent each.

- Tins and sachets made of flexible plastic take the places behind them.

- At the material level, flexible plastic has the highest growth rate at 2.9 per cent. It offers advantages in terms of transport and storage, which makes it increasingly attractive for many manufacturers – especially in view of the trend towards more environmentally friendly and resource-saving packaging solutions. Thanks to the low weight, flexible plastics help to significantly reduce energy consumption and CO2 emissions during transport. Nevertheless, glass is still the most commonly used material.

Leading suppliers and opportunities

- Private label suppliers: The European market for (condiment) sauces is led by private label suppliers, who hold a market share of over 50 per cent.

- These own brands benefit from price-conscious consumers and wide availability in supermarkets.

- In a European comparison, the private label share in the UK is particularly high (56 per cent market share). In contrast, it is rather low in Poland (39 per cent).

- The top 3 brands are Kraft Heinz, Unilever and Nestlé.

- They account for around 20 per cent of the market share and have growth rates of 3.7 – 4.8 per cent.

- They rely on strong brand awareness and broad product portfolios.

- The rest of the market is highly fragmented and characterised by regional and specialised providers, that often offer authentic, local products and serve niche markets.

- Opportunities: There are opportunities for differentiation and market expansion in areas such as premium products and sustainability.

Conclusion and recommendation

- In order to benefit from the opportunities in the dynamic condiment sauces market, the targeted use of data-based analyses is crucial.

- As BP Consultants, we provide you with the necessary foundation for identifying packaging trends early on and using them strategically, with in-depth market studies, store checks and analyses all the way down to the material level.

- We are happy to use our expertise to help you optimise your packaging strategies and lead you successfully into the future.