The new US tariff policy under Trump is placing a considerable strain on the European packaging industry. This applies to almost all material fractions and, in particular, to the packaging machinery sector. We provide you with a concrete overview for the EU, Switzerland, and the UK as well as illustrate the quantitative effects. We also identify the strategic responses needed to remain successful in transatlantic business.

Background

In 2025, Donald Trump’s return to the White House led to comprehensive customs measures:

- In addition to a base tariff of 10 percent for almost all imports (Executive Order of April 2, 2025)

- a uniform tariff rate of 15 percent will apply to the EU from August 1, 2025 (agreement between Trump and von der Leyen on July 27 in Turnberry, Scotland).

- In addition, since July/August 2025, the US has been imposing a special tariff of 50 percent on over 400 steel and aluminium derivatives. Important: These apply only to the metal content of the respective products, not to the total value of the goods.

- On August 7, the new tariff rate for Switzerland was announced.

- On May 8, the United Kingdom and the US agreed on a trade agreement (Economic Prosperity Deal; EPD), which also regulates tariffs.

Regional impact

European Union

According to Eurostat, the EU exported goods worth EUR 531.6 billion to the US in 2024. Packaging machinery and food processing machinery accounted for over $6.1 billion of this total. This segment is particularly affected by the new 15 percent tariff rate.

Switzerland

Since August 7, Switzerland has been subject to a flat-rate tariff of 39 percent. This is combined with special tariffs on steel and aluminium, which primarily affect packaging machine manufacturing.

United Kingdom

The UK pays a base tariff of 10 per cent, which is secured by the Economic Prosperity Deal (EPD) with the US of 8 May 2025. Although the US is the largest market for British exports (15.3 per cent of all UK exports in 2023), its share of turnover in the packaging industry in the narrower sense is significantly lower.

Quantitative impact

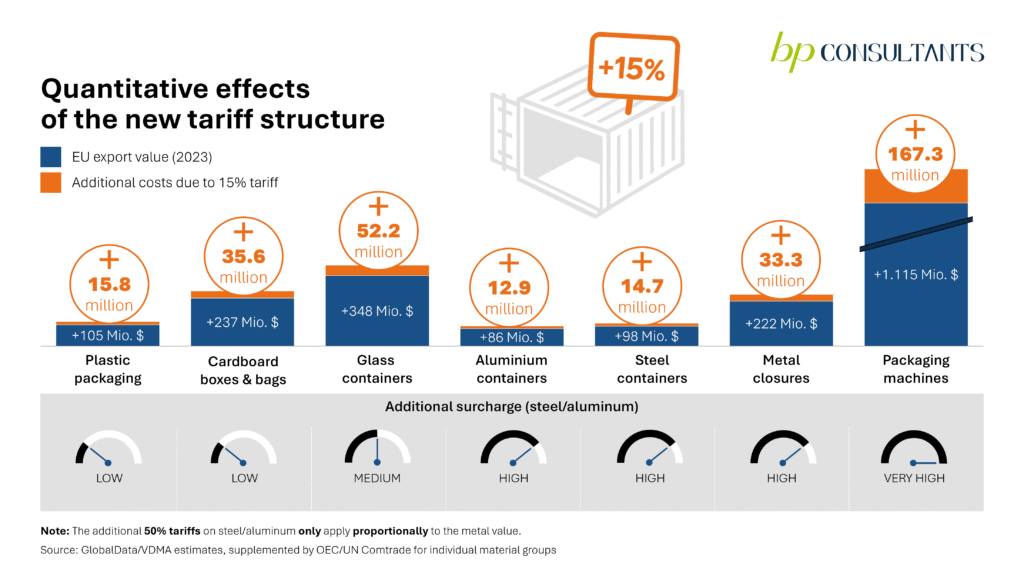

The new tariff structure will have a particular impact on the following product groups (calculation based on 15 percent of the export value to the US):

VDMA response

The German Engineering Federation (VDMA) warns that, despite the 15 percent cap, the EU-US tariff agreement only offers formal planning security. The 50 percent metal tariffs would effectively affect around 30 percent of European machinery exports, including engines, robots, and agricultural equipment. The association is therefore calling for permanent exemptions for these products.

Conclusion

The new tariff rules will lead to significant additional costs for the European packaging industry. This applies in particular to the packaging machinery sector. While the EU and Switzerland are severely affected, the UK remains relatively unscathed thanks to the EPD.

Strategic responses

Strategic responses are crucial to ensuring that the industry can continue to be successful in transatlantic business. These include:

- focus on alternative markets

- localization of production in the US

- automation to offset costs

- material innovation (e.g., less metal content)

- political commitment to exemptions